Mongolia is ramping up efforts to export coal to energy-hungry China, despite global efforts to end the use of the polluting fossil fuel

Mongolia is ramping up efforts to export coal to energy-hungry China, a government official told AFP, despite global efforts to end the use of the polluting fossil fuel.

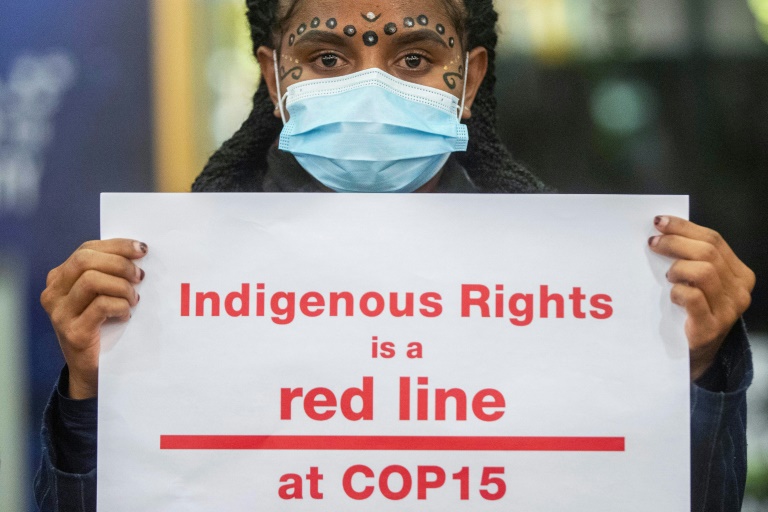

World leaders are gathering at the COP27 conference in Sharm el-Sheikh to hash out the future of the planet, and China’s role in global carbon emissions has been front and centre.

Mongolia already sends 86 percent of its exports to China, with coal accounting for more than half the total, and is upgrading its infrastructure in the hopes of selling even more to its southern neighbour.

“We need to use this window of opportunity, use the next 10 years to be able to export as much coal as we can,” deputy mining minister Batnairamdal Otgonshar told AFP.

China is the world’s largest polluter and has pledged to achieve carbon neutrality by 2060. To that end, it is building out its renewable power grid to prepare for a move away from coal.

But its need for power far exceeds what renewable sources can supply. Chinese authorities ordered producers in spring to add 300 million tonnes of mining capacity this year — the equivalent of an extra month of coal production.

And Mongolia is keen to chip in, shipping 19 million metric tons of coal to China so far this year, according to the National Statistical Office, already exceeding 2021’s 16 million total.

Government officials want Mongolia to surpass the record 37 million tons sent in 2019 and to keep supplying China with a steady stream of coal well into the next decade, Batnairamdal said.

“Coking demand won’t decline in the next 10 years, but the technology may change,” he said. “The next 10 years remain an opportunity.”

Batnairamdal is pushing for Mongolia to invest heavily in coal, and new railways to connect to China’s ports and processing plants.

– ‘Window of opportunity’ –

Time is running out for Mongolia to sell off its thermal coal — used by power plants to make electricity — Batnairamdal said, as coal-fired plants are being phased out.

Soaring prices also mean there is little incentive for Ulaanbaatar to slow down. The value of Mongolia’s coal exports jumped to $4.5 billion in the first nine months of 2022, almost triple what they were over the same period last year.

An unofficial ban on Australian coal sparked by political disputes in 2020 has also opened the door wider to Mongolian exporters, analysts say.

“Without Australia, China’s appetite for low sulphur coking coal creates substantial demand for Mongolian miners,” said Simon Wu, a senior consultant at Wood Mackenzie, a research and consultancy group.

Mongolia missed their chance to export more coal to China after Australian imports fell off, Wu said, blaming a lack of railway connections.

Politicians in Ulaanbaatar are now working to fix that.

Ulaanbaatar finished a 233-kilometre (145 mile) rail line from the Tavan Tolgoi mine to the Gashuun Sukhait border in September, a project that took 14 years to complete.

Analysts also say relative political stability in Mongolia could help the government finish other long-delayed projects.

– ‘Trade will open up’ –

Tumentsogt Tsevegmid, chairman of the Business Council of Mongolia, told AFP the infrastructure now in place, combined with projects already in progress, could allow Mongolia to push coal exports to 70 million tons annually, possibly by 2025.

“If China is willing to import more coal, and there is more work done to improve borders and railways lines, then trade will open up,” Tumentsogt said.

With a population of just 3.3 million, Mongolia has little heavy industry and does not by itself consume much coal compared to its southern neighbour.

It accounts for just 0.11 percent of the world’s greenhouse gas emissions, according to the United Nations, but is already being severely affected by climate change.

Strong winter storms, along with drought and wildfires, have displaced communities, forcing nomadic families into the capital after losing their livestock.

The United Nations says climate change is making these natural disasters more common in Mongolia, with overcrowding in unplanned areas of Ulaanbaatar leading to soil and air pollution — especially in winter, when raw coal is burned in residential stoves to fend off freezing temperatures.

“The contradiction will remain,” said Tumentsogt, when asked about Mongolia both producing coal for export while also investing in renewables.

“Mongolia has a dilemma, it needs short-term cash revenue to meet its fiscal needs and at the same time is trying to invest in costly renewables to reduce its carbon footprint, reduce air pollution and contribute to global sustainability efforts.”

Tumentsogt said Mongolia’s cash crunch has only one fix for now — sell more coal.

“Coal deliveries and exports will remain as one of the major sources of revenue for the government and there are no other sources that can replace this fiscal need.”